Member Managed LLC vs Manager Managed LLC

Member Managed LLC vs Manager Managed LLC

Individuals who decide to form a limited liability company (LLC) will have to choose their LLC’s management structure when drafting the LLC formation agreement. Under some LLC operating agreements, all the members contribute to the everyday operations of the business while in other LLC operating agreements managers are designated to manage the operations. LLC owners need to draft a formation and operating agreement that spells out who is responsible. Any mistake made can drastically impact who has the management control and what rights the members hold. That’s why understanding the difference between member-managed LLC vs manager-managed LLC is important.

Understanding the Vital Role of LLC Operating Agreements:

LLC operating agreements are extremely important to the functioning and management of the LLCs. These agreements define the roles and duties of the managers and members. They also serve to define which type of management structure will be used and what level of authority and decision-making capabilities the managers and members have.

Failure to outline these types of roles, duties, and decisions in your LLC operating agreement means that state law will apply by default. Default state rules can result in giving unplanned control to a few members or leaving members open to liabilities. A start-up or business attorney can help you avoid such a situation by drafting an LLC operating agreement that addresses all suitable issues.

Nearly all small business owners know that LLCs are legal structures that protect them from personal liability for company debts. Still, many individuals do not understand that LLCs can have two types of management structures- member-managed and manager-managed.

Member-Managed Vs. Manager-Managed LLCs:

With a member-managed LLC, all the members can participate in the company management and function similarly. Every LLC registered agent has a vote in the major decisions and can make decisions on behalf of the company. However, contracts and loan agreements are liable to need majority approval.

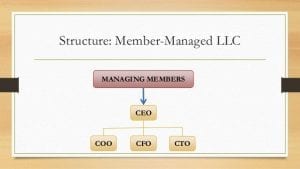

On the other hand, with the manager-managed LLC, only specific members, non-members or a blend of the two controls the daily business functions. The other members operate as passive investors who do not have a vote in the functional decisions.

While both the options serve amazing benefits including pass-through taxation and legal security, they also have a few significant differences that can affect their LLC’s success.

Primary Advantage of Member-Managed LLCs:

In nearly all states, the member-managed LLC is a default form of LLC and this format is considered to be typical, principally for the small businesses having very few members. Operating as a member-managed LLC is beneficial for start-ups who desire to ensure that every member has important input about the daily operations of the business.

Primary Advantage of Manager-Managed LLCs:

In the LLC registration process, a manager-managed LLC is not very common. It is extremely useful if you desire your startup to operate more like a corporation. If an LLC is manager-managed then, the LLC owners put into effect their control through voting on the primary company issues, instead of getting actively involved in the company’s daily operations. This could be beneficial for startups in the following situations-

- Large Startup: If you have a large startup company or have a large number of owners then, it is not sensible for all the members to get involved in every decision about the management of the company. Rather, a manager-managed LLC can respond speedily to the changing financial conditions and take action without profound administrative troubles. This also enables the members to employ the assistance of outside counsel and non-members by exact areas of expertise while making decisions.

- Preferred Secrecy: Usually, all the members should be listed openly in the LLC operating agreements of the member-managed LLCs. More secrecy can be attained in the manager-managed LLCs.

- Passive Ownership: At times, you may have members who are not concerned about playing an active role in the business. A manager-managed LLC makes it doable to employ one or multiple managers to manage the company affairs, leaving the other members free to uphold a passive role.

The right time to decide who will manage your LLC is before you commence your business operations and your LLC formation and operating agreement must specify who will manage your LLC and how decisions will be taken. Never leave these essential steps to put into action for later to avoid legal difficulties.

Now that you know the difference between member managed llc vs manager managed llc, if you need help with LLC registration in Texas, or need a Texas registered agent, please don’t hesitate to contact us.